<--- Back to Details

| First Page | Document Content | |

|---|---|---|

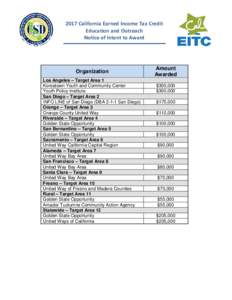

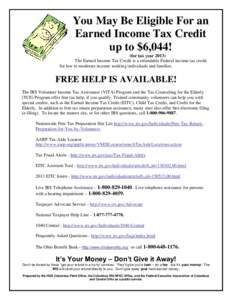

Date: 2016-06-23 16:37:49Taxation in the United States Income distribution Government Income tax in the United States Tax return Earned income tax credit Tax Social Security Income tax IRS tax forms 529 plan |

Add to Reading List |

VERIFICATION WORKSHEET INDEPENDENT STUDENTS VERIFICATION WORKSHEETI INDEPENDENT STUDENTS Southern Illinois University Carbondale

VERIFICATION WORKSHEET INDEPENDENT STUDENTS VERIFICATION WORKSHEETI INDEPENDENT STUDENTS Southern Illinois University Carbondale