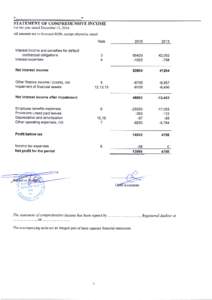

81 | Add to Reading ListSource URL: www.oca.nh.govLanguage: English - Date: 2013-08-13 10:27:09

|

|---|

82 | Add to Reading ListSource URL: redcliff-nsn.govLanguage: English - Date: 2017-11-27 13:12:48

|

|---|

83 | Add to Reading ListSource URL: riverlink.comLanguage: English - Date: 2018-01-31 10:45:50

|

|---|

84 | Add to Reading ListSource URL: www.navajonationcouncil.orgLanguage: English - Date: 2018-03-29 18:33:41

|

|---|

85 | Add to Reading ListSource URL: www.hcpafl.orgLanguage: English - Date: 2018-02-02 13:44:35

|

|---|

86 | Add to Reading ListSource URL: www.iuvo-group.comLanguage: English - Date: 2018-06-19 04:05:30

|

|---|

87 | Add to Reading ListSource URL: www.nagoya-u.ac.jpLanguage: English - Date: 2018-01-19 03:50:34

|

|---|

88 | Add to Reading ListSource URL: www.retirestronger.comLanguage: English - Date: 2015-12-04 03:49:28

|

|---|

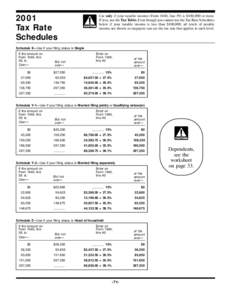

89 | Add to Reading ListSource URL: www.unclefed.comLanguage: English - Date: 2009-01-12 09:09:14

|

|---|

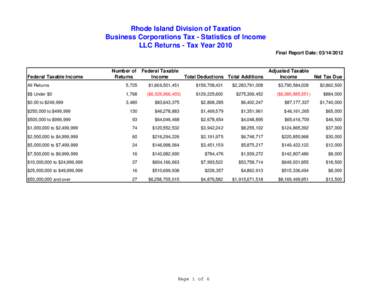

90 | Add to Reading ListSource URL: www.tax.ri.gov.Language: English - Date: 2012-03-15 15:33:35

|

|---|